Should you’re trying to monetize a documentary letter of credit (DLC), you must ensure that you supply all the necessary files and data towards the monetizer. At MG Funds, We now have a proprietary approach in position that requires you to offer us with the following documents:

Our group will very carefully critique your case and provide the very best alternatives to make sure a smooth and prosperous monetization procedure. Have confidence in and transparency are for the Main of our organization, and we pride ourselves on giving the highest volume of support to all our shoppers.

Homework: The monetization provider conducts a thorough due diligence procedure to evaluate the authenticity and validity on the SBLC. This includes verifying the terms and conditions outlined during the SBLC.

Standby Letters of Credit history (SBLC) are assures of payment by a financial institution on behalf in their consumer. They serve as a safety Internet for the beneficiary, making sure payment sblc provider Should the applicant (the bank’s shopper) fails to fulfill a contractual obligation.

Acquire loans by utilizing your property holdings as stability, unlocking money for numerous money wants.

Offering this data will help us to evaluate your bond’s price and determine if it satisfies our conditions for monetization.

Only on reviewing the copy of the SBLC & sender’s CIS, we can quote the LTV% that we will give for that particular instrument.

This process includes a arduous creditworthiness assessment To guage the economical well being with the entity.

Verified Letter of Credit: Features a warranty from a next lender in addition to the issuing lender, providing further safety on the beneficiary.

SBLC monetization is the entire process of liquidating/converting an SBLC into liquid resources, typically by way of a money institution or monetizer.

Negotiate Phrases: Agree about the terms of your monetization, such as the funding amount and all service fees involved.

Reserve a session contact nowadays to plan a consultation and find out more about how our monetization solutions can advantage you.

Attain loans by using your property holdings as stability, unlocking capital for numerous money requires.

Lender instrument monetization can be a preferred financing procedure for businesses looking to get credit rating line, mainly because it enables them to secure the strains of a credit history line with a credible financial institution and instrument operator’s funds nicely.

Rick Moranis Then & Now!

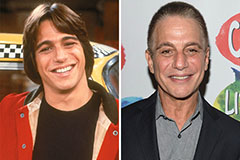

Rick Moranis Then & Now! Tony Danza Then & Now!

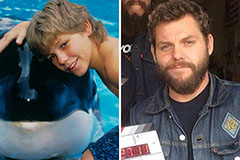

Tony Danza Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!