Lender instruments are a favorite avenue for individuals and organizations to get financing or safe transactions for goods and products and services.

A letter of credit rating, also referred to as an SBLC, is yet another variety of credible bank instrument that is often Employed in Global trade.

Monetization Arrangement: Once the SBLC is validated, the SBLC holder as well as monetization provider enter into an settlement, which outlines the terms, problems, and charges linked to the monetization procedure.

It necessitates demanding creditworthiness verification, imposing sizeable obligations to the issuing bank to pay for the beneficiary on presentation on the stipulated documents.

The use of SBLC really helps to mitigate the dangers affiliated with Worldwide trade and offers assurance to equally the customer and the vendor. Having said that, in sure circumstances, the beneficiary may possibly call for instant hard cash or credit rating instead of watching for the maturity in the SBLC. This is when SBLC monetization comes in.

One particular frequent use for devices is to provide cash flows for traders. These devices tend to be most well-liked more than volatile investments like stocks simply because they offer a constant supply of cash flow.

The first step in monetizing an SBLC is to acquire what is mt700 a single in hand. The SBLC is usually issued by a financial institution or fiscal establishment at the request in the applicant and is also built payable on the beneficiary.

Repayment Conditions: Conditions of repayment or service fees are established, with regards to the monetization agreement.

Authorized Assistance: Talk to with authorized gurus who're well-informed about Worldwide trade and financial devices. They will let you navigate the legal complexities from the transaction.

Deciding on a reliable Standby Letter of Credit (SBLC) provider can be a essential phase that needs thorough homework to ensure the integrity and trustworthiness of the fiscal instrument.

This process requires offering the SBLC to your third party, generally a monetization business, which then provides monetary payment into the holder which has a percentage of your money paid out towards the deal with worth of the SBLC in income.

SBLC monetization is notably common in worldwide trade, in which industries prioritize danger mitigation. Its use is prevalent in sectors that involve sizeable assures due to Global nature of their transactions.

Due diligence should include things like a review from the conditions and terms in the SBLC, the economic strength of your issuer, and also the track record with the monetizer. The functions must also look for legal advice to make certain the SBLC monetization procedure is legal and complies with applicable guidelines and rules.

Every gain underscores the strategic benefit of leveraging standby letters of credit, reworking them into active financial resources.

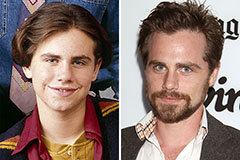

Rider Strong Then & Now!

Rider Strong Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!